AI in Fintech: Advantages, Use Cases, and Challenges You Should Know About

Want to know more? — Subscribe

Artificial intelligence in fintech enhances daily operations, reduces risk exposure, and unlocks new service models. According to the Cambridge Centre for Alternative Finance, 80% of fintech companies now use AI across multiple business areas.

Customer service and process automation lead the way. 91% of fintechs have already adopted AI in these areas or plan to do so soon. The impact is also clear: 83% of fintechs report better customer experiences, while 75% see notable cost savings and stronger profitability.

In this article, Softermii analyzes the benefits, challenges, and practical applications of AI in fintech. Our experts provide practical insights on how companies can leverage these technologies to optimize operations and enhance their market position.

AI's Impact on FinTech

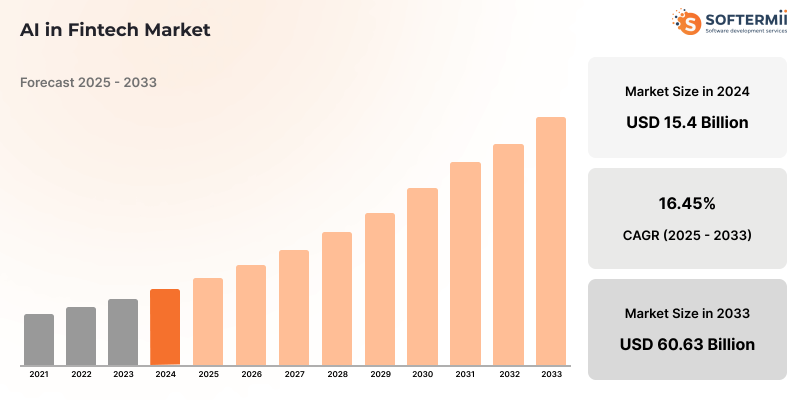

Artificial intelligence is no longer just a support tool in the financial industry. What began with simple automation in the back office has evolved into something much larger. In 2024, the global AI in FinTech market reached $15.4 billion. It's expected to hit $60.3 billion by 2033. That's a compound annual growth rate (CAGR) of 16.45%, according to Future Market Insights.

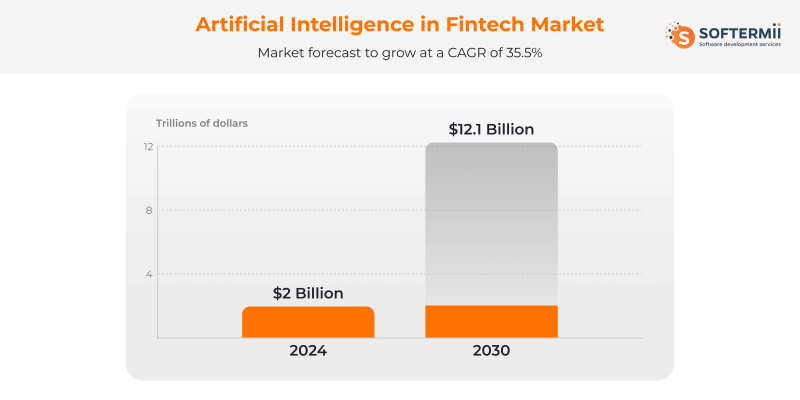

Generative AI is growing even faster. This segment was valued at $2 billion in 2024. By 2030, it's projected to reach $12.1 billion with a CAGR of 35.5%. These numbers demonstrate the rapid evolution of AI from a strategic priority to an operational standard in finance.

Today, AI enables financial institutions to reduce costs, make faster decisions, and enhance customer experiences. Key areas of focus include:

- Process automation: Tasks like KYC checks, claims processing, and credit underwriting are now more efficient. AI reduces the need for manual input, speeds up turnaround times, and allows these processes to run 24/7 across different time zones.

- Personalized financial services: Intelligent systems deliver tailored insights on saving, spending, and investing. This level of customization enables providers to build stronger relationships and enhances long-term retention.

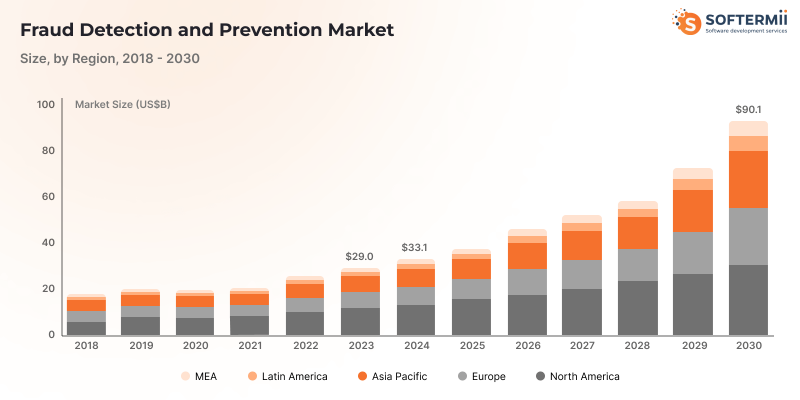

- Fraud prevention and compliance: AI is used for real-time monitoring, anomaly detection, and dynamic risk scoring. The fraud detection market, partly powered by these tools, is expected to exceed $90.07 billion by 2030.

- Lending and credit scoring: As of 2024, around 45% of loan decisions involve AI-based analysis. This accelerates approval times and improves the accuracy of risk assessment, according to CoinLaw.

The Difference Between AI and Machine Learning for FinTech

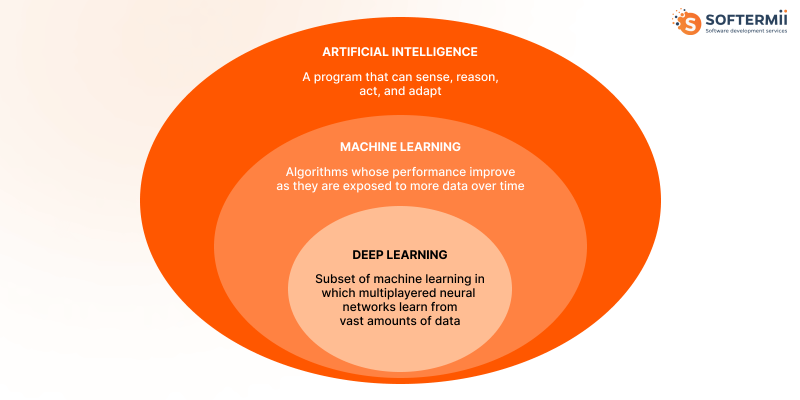

Artificial intelligence and machine learning are closely connected, but not interchangeable. In fintech, both play important roles. Understanding the difference helps clarify how each contributes value to financial operations and product development.

Artificial intelligence is the broader concept. It includes systems designed to handle tasks that usually require human input, such as recognizing patterns, detecting anomalies, or making decisions based on data. This applies to both structured formats, such as spreadsheets, and unstructured ones, like emails or voice messages.

AI supports a wide range of tools used in finance today. Real-time fraud monitoring, automated onboarding, compliance tracking, and conversational interfaces are all built on AI. These solutions enable firms to respond more quickly, reduce costs, and enhance accuracy.

Machine learning is a subset of the broader field of AI. Its role is about building systems that improve on their own by learning from data. These systems don't rely on fixed rules. Instead, they adjust based on patterns found in historical and real-time information.

In fintech, machine learning is applied to credit scoring, risk modeling, and investment planning. Models are trained on large volumes of data to spot trends, flag inconsistencies, and improve future predictions. The more data they receive, the more accurate they become.

A more advanced layer, deep learning, takes this further. It utilizes neural networks to process complex data types, including voice, images, and written text. These tools help automate decisions that previously required human oversight. Thus, deep learning enables more advanced capabilities:

- reviewing ID documents during onboarding;

- tracking tone and intent in client messages;

- forecasting market movements using real-time signals.

In practice, each technology serves a different purpose:

- Artificial intelligence lays the groundwork. It enables systems to perform tasks that mimic human decision-making.

- Machine learning adds flexibility. It allows systems to learn from data and improve over time. The goal is to refine outcomes in response to changing inputs.

- Deep learning pushes this further. It handles large, complex datasets and builds models that can process them with high accuracy.

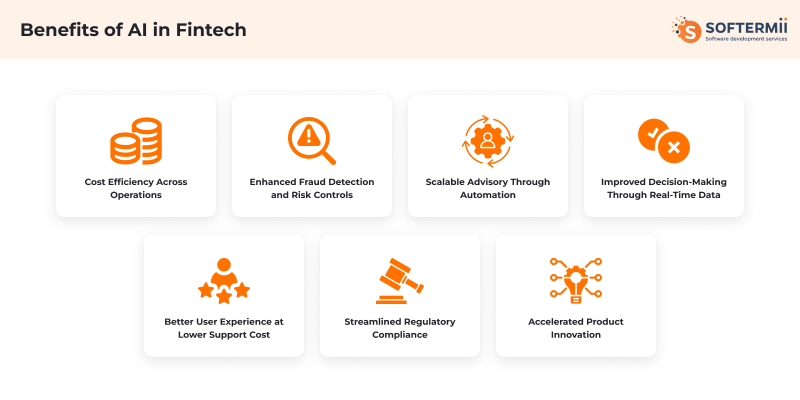

Benefits of AI in FinTech

Integrating artificial intelligence into fintech is a direct response to the evolving needs of businesses. It's about lowering costs, managing risk, and keeping pace with customer expectations. The focus is less on the technology itself and more on where it creates a measurable impact.

Cost Efficiency Across Operations

Reducing costs is one of the most significant wins. AI automation streamlines manual work across multiple functions, enabling faster and more accurate handling of tasks such as data entry, identity checks, onboarding steps, and compliance reporting. This frees up teams to focus on higher-value tasks.

Enhanced Fraud Detection and Risk Controls

AI is changing how financial institutions detect and prevent fraud. Machine learning models can analyze thousands of data points in real time to flag unusual patterns or behaviors. These systems are trained on historical and current data to adapt as fraud tactics evolve. The result is faster detection, fewer false positives, and stronger customer protection.

Scalable Advisory Through Automation

Financial advice is no longer limited to high-net-worth clients. With automation, financial platforms can now deliver guidance to users at every level. Robo-advisors process individual goals, financial history, and behavior to generate personalized recommendations.

Budgeting, saving, and long-term planning are all handled through a consistent and scalable system. This provides meaningful user support and removes the need for large advisory teams. For fintech firms, it's a way to grow reach without increasing operational complexity or costs.

Improved Decision-Making Through Real-Time Data

AI systems can process high volumes of real-time information from internal and external sources. Instead of relying on static reports, teams can act on what's happening now. The result is more stable operations and stronger business outcomes.

Artificial intelligence supports faster decisions across departments. Credit risk assessments become more precise. Insurance pricing adjusts to live market shifts. Liquidity is managed proactively instead of reactively.

Better User Experience at Lower Support Cost

Customer support is a significant cost center in the financial services industry. AI chatbots and virtual assistants help ease that load. They handle large volumes of inquiries, cutting queue times and improving response rates.

Customers get quicker answers, and teams stay focused on complex issues. These tools also maintain consistent communication, especially during peak hours or product launches. The result is a better experience for users without stretching support resources.

Streamlined Regulatory Compliance

Artificial intelligence automates monitoring and reporting tasks. This reduces the chance of human error, which can be costly in compliance-heavy environments. Faster and more accurate reporting also speeds up audit preparation. This way, firms avoid penalties and maintain trust with regulators.

Accelerated Product Innovation

Solutions with AI offer deeper insights by analyzing customer behavior and market trends. These signals reveal more opportunities for new products and services. Thus, businesses can respond faster and create offerings that stand out in a crowded market. It also opens doors to reaching segments that were previously overlooked or underserved.

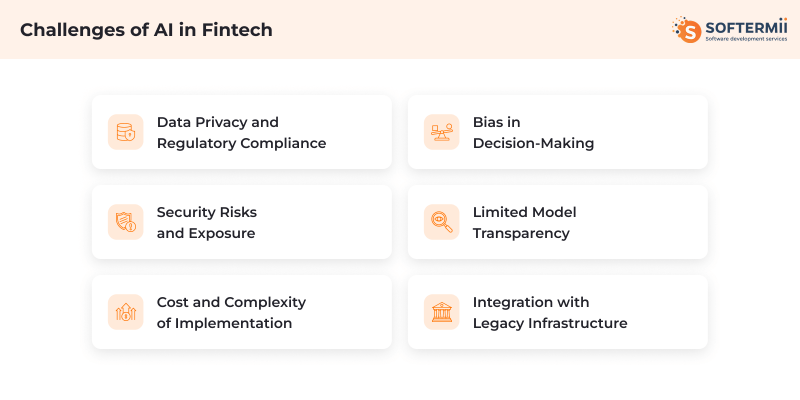

Challenges of AI in FinTech

AI can improve performance and lower costs, yet its adoption in fintech comes with serious responsibilities. Operational, legal, and technical risks must be addressed early. Otherwise, the same tools meant to improve efficiency can create exposure or stall innovation.

Data Privacy and Regulatory Compliance

Fintech firms are held to some of the strictest data regulations across any industry. Systems must process personal, financial, and behavioral data while remaining compliant with GDPR, CCPA, and other regional regulations. Privacy, auditability, and transparency should be integral to the system architecture from the outset.

A key challenge is explaining how automated decisions are made. Credit approvals. Transaction monitoring. Risk scoring. These outcomes must be comprehensible to regulators, internal teams, and end-users.

Companies also need to maintain clear records of where data originated and how it was utilized. It's especially crucial as audits and regulatory reviews become more detailed.

Security Risks and Exposure

AI systems rely on large volumes of data to function well. In fintech, much of that data is sensitive, including transaction histories, personal identifiers, and financial behavior. If the underlying infrastructure isn't secure, the risk of breaches increases sharply.

Even well-trained models can expose patterns or individual insights if outputs are not carefully managed.

The danger also lies in how the data is used and shared. Poorly filtered results, weak oversight, or unclear accountability can lead to widespread exposure. Without strong data governance, artificial intelligence may create new vulnerabilities rather than mitigating them.

Cost and Complexity of Implementation

AI has long-term cost advantages, but the short-term reality is different. Building or customizing models, securing infrastructure, and hiring the right talent takes time and resources. These investments are necessary, but they also carry high risk if not managed properly.

For firms without internal expertise, even basic implementation can become a challenge. Projects slow down. Budgets expand. Business goals are missed. Without a clear plan and realistic expectations, AI initiatives risk becoming costly experiments rather than strategic assets.

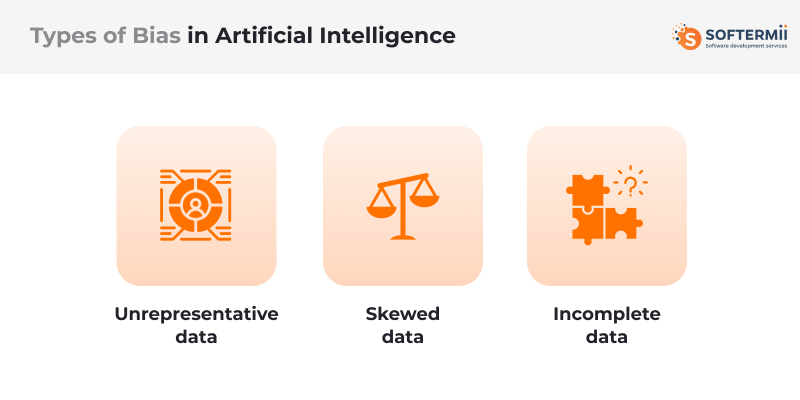

Bias in Decision-Making

In the financial industry, historical datasets often carry traces of social or economic bias. When those patterns are embedded into algorithms, the results can be skewed. Credit scoring, fraud checks, and loan approvals are especially vulnerable.

Even a slight bias can lead to unfair treatment, regulatory pushback, or damage to a brand's reputation.

Addressing this is a matter of responsibility. Systems must be designed with fairness in mind. That means regular testing, clear documentation, and the ability to explain how decisions are made. Ethical oversight should be an integral part of the process from the outset.

Limited Model Transparency

In many fintech applications, companies must be able to justify their decisions. The problem is that many machine learning models, especially deep learning ones, lack transparency. They produce outcomes, but can't always show how those outcomes were reached.

This becomes a barrier in regulated areas, such as lending or compliance. If teams can't justify results, adoption slows down, regulators ask more questions, and internal trust erodes. Thus, even high-performing systems can struggle to gain traction where it matters most.

Integration with Legacy Infrastructure

Many financial institutions still rely on legacy systems. These platforms were not built for real-time processing or high-volume data flows. Adding AI into the mix often exposes deeper issues, such as outdated architecture, poor data quality, or fragmented workflows.

In such cases, AI integration may necessitate a comprehensive review of systems, processes, and data pipelines. That means time, investment, and coordination across teams. For some companies, this becomes the most significant barrier to adoption. Without a clear modernization roadmap, AI projects can stall before they begin.

Real-Life Use Cases of AI in FinTech

Today's top fintech companies are already building their processes with AI. The focus is on achieving results: stronger revenue, improved risk controls, and more streamlined operations. Below are real examples of how five major firms are using AI in their core systems.

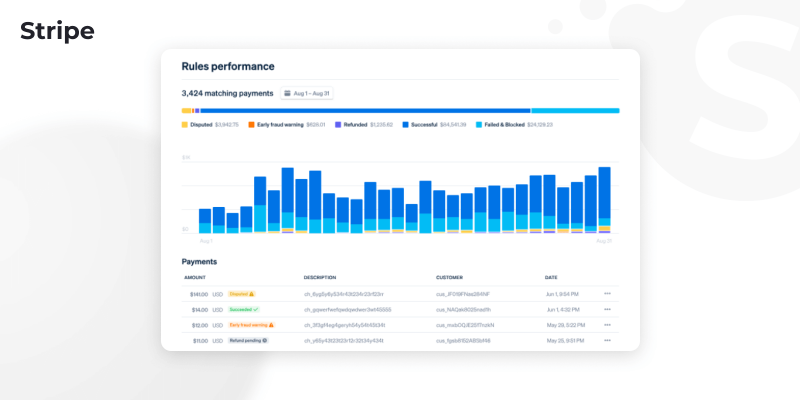

Stripe

Stripe utilizes AI throughout its payment stack to enhance customer conversion and improve fraud protection. Its Optimized Checkout Suite analyzes real-time user behavior and context to adjust the checkout flow. On average, this lifts revenue by 11.9%.

On the risk side, Stripe's Radar system utilizes machine learning to detect fraud more precisely, resulting in a 38% reduction in fraud rates. Smart Disputes goes a step further, helping businesses recover more chargebacks through automated evidence submission and resolution tracking.

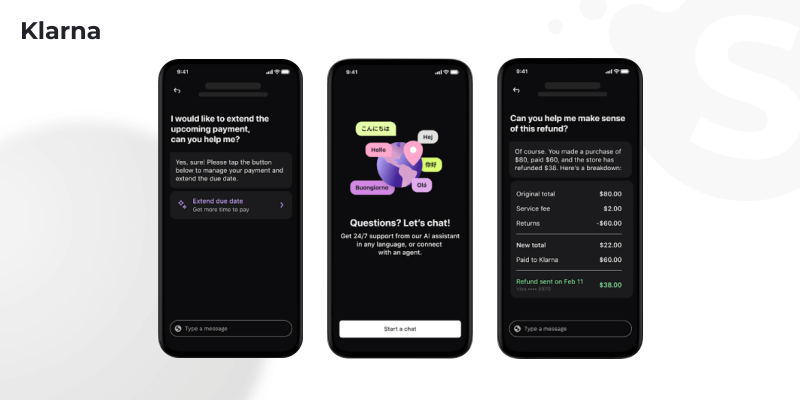

Klarna

Klarna utilizes AI to enhance customer service and streamline internal operations. Its virtual assistant now handles nearly two-thirds of all customer chat interactions. This reduces pressure on human agents while maintaining consistent response times.

On the backend, AI tracks transaction patterns to adjust fraud detection thresholds in real time. Klarna's marketing team also benefits. By automating content creation and performance tracking, they've cut agency costs by 25%.

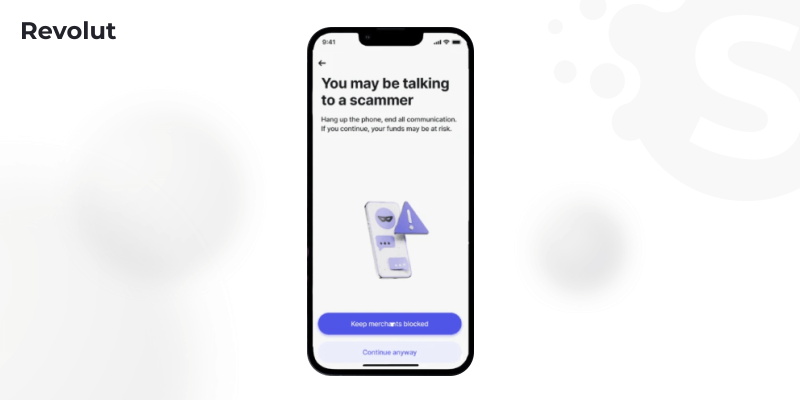

Revolut

Revolut utilizes AI in various customer-facing and internal applications. One key feature is its scam-interruption tool. It monitors user activity in real-time and flags signs of fraud before money is transferred from the account. This has helped reduce fraud-related losses by approximately one-third.

Document scanning and identity verification tools quickly and accurately verify user data. This accelerates the sign-up process while staying compliant. Revolut's in-app financial assistant analyzes users' spending behavior and provides practical, personalized tips to help them manage their finances more effectively.

TradingView

TradingView uses AI to make technical analysis more accessible and actionable. Their "All Chart Pattern" tool scans real-time data to detect classic formations, such as double tops, wedges, and triangles. This way, it enables traders to react more quickly to emerging signals.

The company also supports user-generated content. Many scripts created on the platform use machine learning to forecast trends or generate trade signals. This provides users with more flexible and data-driven methods for testing and refining their strategies.

Chime

Chime developed its internal machine learning platform, MLKit, to accelerate model deployment across the company. What once took two months now takes three weeks. This speed matters as Chime scales its use of machine learning in fraud detection, account security, and member engagement.

The platform supports more than 40 active models in production. It also standardizes how teams build, test, and manage those models. MLKit reduces duplication and helps maintain consistency across teams working with data.

Trends and Use Cases of AI in FinTech

The focus of AI development in fintech has shifted toward solving real problems and creating operational value. Below are the key trends and where they're making the biggest impact.

Intelligent Automation

Routine and rule-based tasks are being handed off to automated systems. This includes onboarding, ID verification, loan underwriting, and payment matching. The goal is straightforward: reduce manual work, expedite turnaround, and minimize errors.

Automation doesn't remove humans from the loop; instead, it enhances their capabilities. Instead of reviewing every file, teams focus on exceptions and edge cases. A loan application, for example, can be processed in seconds with risk models scanning multiple data points. Teams step in only when needed, improving efficiency without lowering oversight.

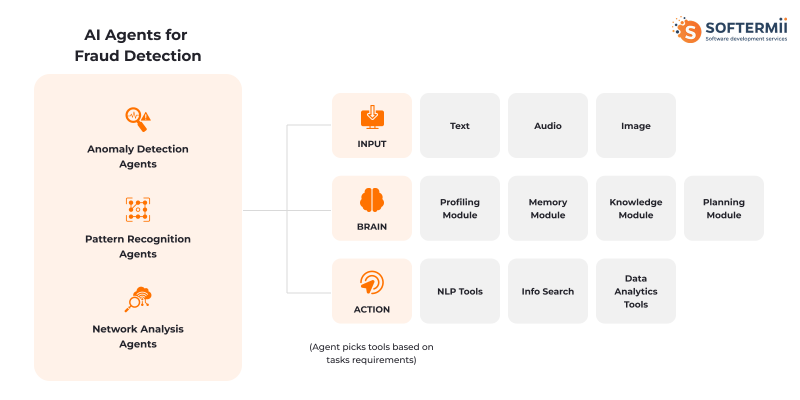

Fraud Prevention and Risk Monitoring

Fraud is becoming increasingly difficult to detect with static rules alone. Machine learning helps by scanning large volumes of data (user activity, device behavior, transaction flows) in real time. These systems adjust as new threats emerge.

Digital banks, wallets, and lenders use them to flag suspicious activity early without creating friction for genuine users. The aim is to strike a balance between safety and a smooth user experience, and AI is helping firms manage this balance better.

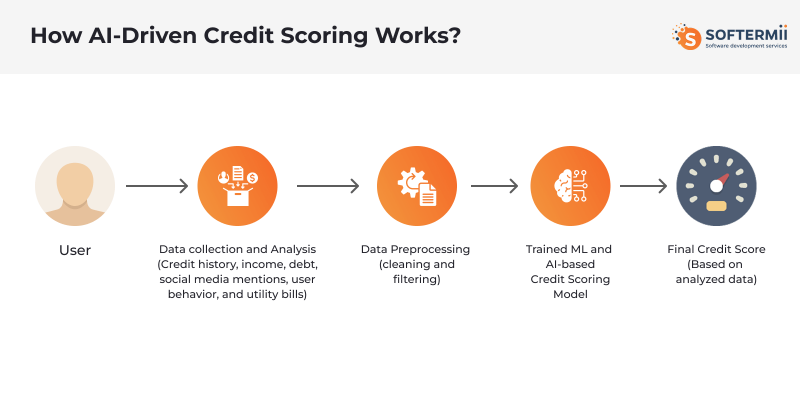

Real-Time Credit Scoring

Traditional credit models rely on historical data to inform their decisions. Yet, they don't always capture a full or current picture. AI-driven scoring adds another layer. It looks at live behavioral signals, spending patterns, and alternative data sources.

This helps lenders assess risk more accurately and in real time. It also broadens access to credit, especially in markets where formal credit histories are limited. Borrowers get faster decisions and lenders gain a sharper view of potential risk. The result is smarter lending without unnecessary exposure.

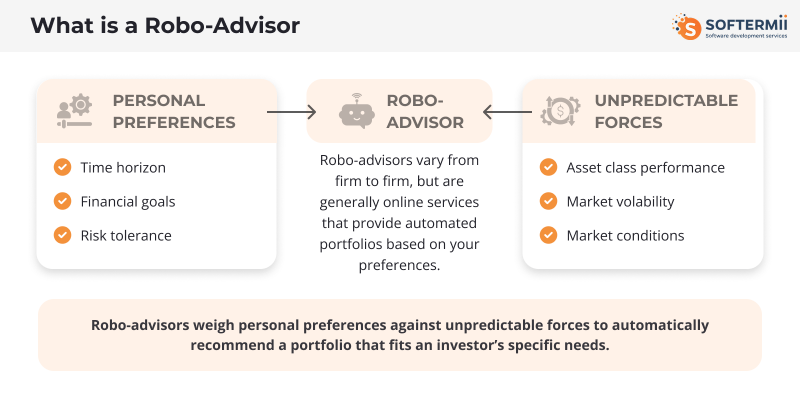

Personalized Financial Advice (Robo-Advisory)

Robo-advisors are becoming more sophisticated. They analyze real user data (transaction records, preferences, goals) to build customized financial plans. These systems help users manage savings, investments, and even debt more strategically.

For fintech platforms, it's a way to offer quality advice at scale, reaching both entry-level users and experienced investors without adding high operational costs.

Predictive Analytics in Customer Engagement

Understanding what users need before they ask is becoming a competitive advantage. Fintech platforms are using predictive analytics to stay ahead. These models track usage patterns, transaction behavior, and engagement signals to flag churn risks or upcoming needs.

This is especially valuable in subscription-based or volume-driven models. Predictive tools can even catch the smallest changes in user habits. That allows for timely outreach, targeted offers, or adjusted product recommendations. Over time, this improves retention and helps make better product decisions.

AI-Driven Compliance Tools

AI-powered tools assist with transaction monitoring and compliance checks. They help flag potential breaches and prioritize review cases. Systems can analyze communication records and transaction data. This way, they support adherence to KYC, AML, and data privacy regulations. It's a smarter way to meet regulatory demands while maintaining efficient workflows.

Our Expertise

Softermii builds fintech platforms designed for performance, scale, and trust. The Expedipay and EXtoBit projects highlight how the right infrastructure and product design can support secure and high-volume operations without sacrificing user experience or compliance.

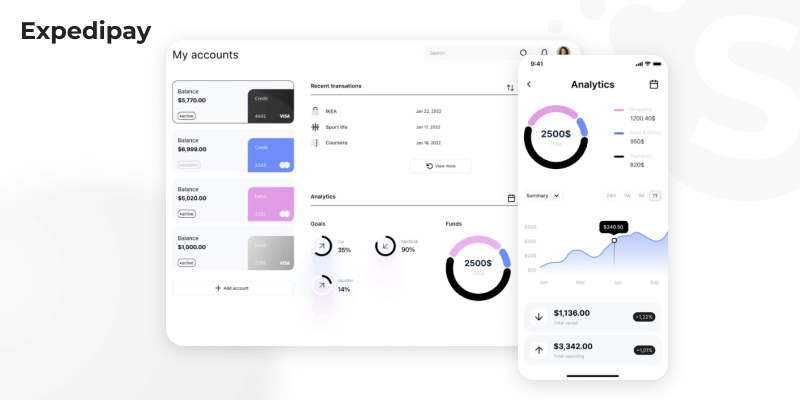

Expedipay

Expedipay provides a seamless mobile banking experience, with a focus on secure peer-to-peer (P2P) transfers and straightforward onboarding. The app is developed to strike a balance between ease of use and a secure, regulation-ready architecture.

Business Impact

- 13,000+ downloads in the first 3 months

- 1.35 million money transfers completed

- 4.1 average transfers per user per day

Key Features

- Real-time P2P transfers with low friction

- Built-in eKYC and AML for fast and compliant sign-up

- In-app live chat for immediate support

- Secure card storage for faster repeat payments

- Fraud detection tools built into core processes

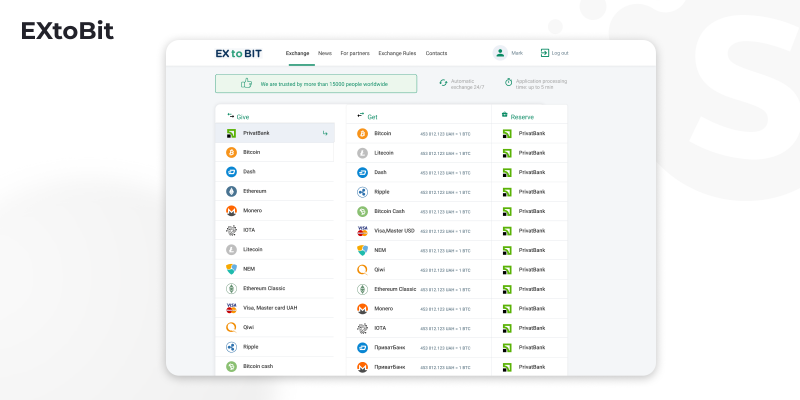

EXtoBit

EXtoBit is a web-based crypto exchange designed for speed, flexibility, and security. The platform separates environments for customers, staff, and backend operations. ExtoBit supports synchronized data processing and high transaction volumes.

Business Impact

- 20,000 users joined within the first month after launch

- 84,000 exchanges completed in the first two months

- Achieved break-even point in four months

Key Features

- Modular backend that isolates services for better security

- Real-time market data and trend visualization

- Optimized user interface for rapid trade execution

- Webhook-based data syncing across system components

- Role-specific interfaces for users, managers, and staff

Conclusion

Artificial intelligence enables fintech companies to expedite decision-making, reduce costs, enhance security, and improve their customer experiences. The benefits are clear, but adoption isn't without challenges. Success requires careful planning that considers regulatory compliance, data privacy, and technological complexity.

At Softermii, we specialize in developing custom AI solutions for fintech companies. We combine deep industry insight with technical expertise to build scalable, secure, and compliant platforms. Contact us to build an AI project tailored specifically to your business needs.

Frequently Asked Questions

How is AI applied in fintech today?

AI helps automate tasks, assess financial risk, detect fraud, and deliver personalized insights. Common use cases include credit scoring, real-time transaction monitoring, robo-advisory, and customer support automation. These applications reduce manual work, allowing teams to focus on higher-impact decisions.

Which AI technologies are most relevant to fintech?

- Machine learning is used for data modeling and risk analysis.

- Natural language processing (NLP) powers chatbots, support tools, and document processing.

- Computer vision aids in verifying identity through facial recognition and document scanning.

- Predictive analytics is used to forecast user behavior, flag churn, and inform product updates.

What are the main benefits of using AI in fintech?

AI helps reduce operating costs and supports better fraud detection, more precise credit risk analysis, and streamlined onboarding. Teams can serve more users without expanding headcount. It also improves personalization, making financial services more relevant and accessible to individual users.

Why does AI matter in financial services?

Financial institutions handle large volumes of data and operate in fast-changing environments. AI helps process that data quickly, identify patterns, and reduce risk exposure. It also supports faster responses to market shifts and regulatory changes.

Is AI secure and compliant for financial services?

When implemented carefully, AI can strengthen security and help meet compliance requirements. These systems are designed to spot suspicious activity, monitor for regulatory breaches, and adjust as rules evolve. Yet, their success depends on more than just technology. Key requirements include:

- strong data governance to protect sensitive information;

- clear oversight of models to ensure they perform as intended;

- prioritizing compliance with privacy laws from the start;

- continuous review and updates to maintain security and regulatory alignment.

How about to rate this article?

0 ratings • Avg 0 / 5

Written by: